Philosophy

Investment Philosophy

Navigating Your Financial Future with Confidence

Our Philosophy

In a world of complex and ever-changing financial markets, we understand the challenges investors face. That’s why we’ve dedicated ourselves to creating a smarter, more resilient approach to investing. Our mission is to help you navigate your financial future with confidence.

Risk Management: The Cornerstone of Our Philosophy

Omega Squared recognizes that downside risk poses a greater threat to long-term investment success than upside potential. A significant loss requires a disproportionately larger gain to recover, making risk mitigation a top priority.

We understand that investors are inherently loss averse, and we share this perspective. Our investment strategies are designed to protect your capital during market downturns, ensuring that you can participate fully in the upside potential when the market recovers.

To achieve this, we employ a range of risk management strategies, including:

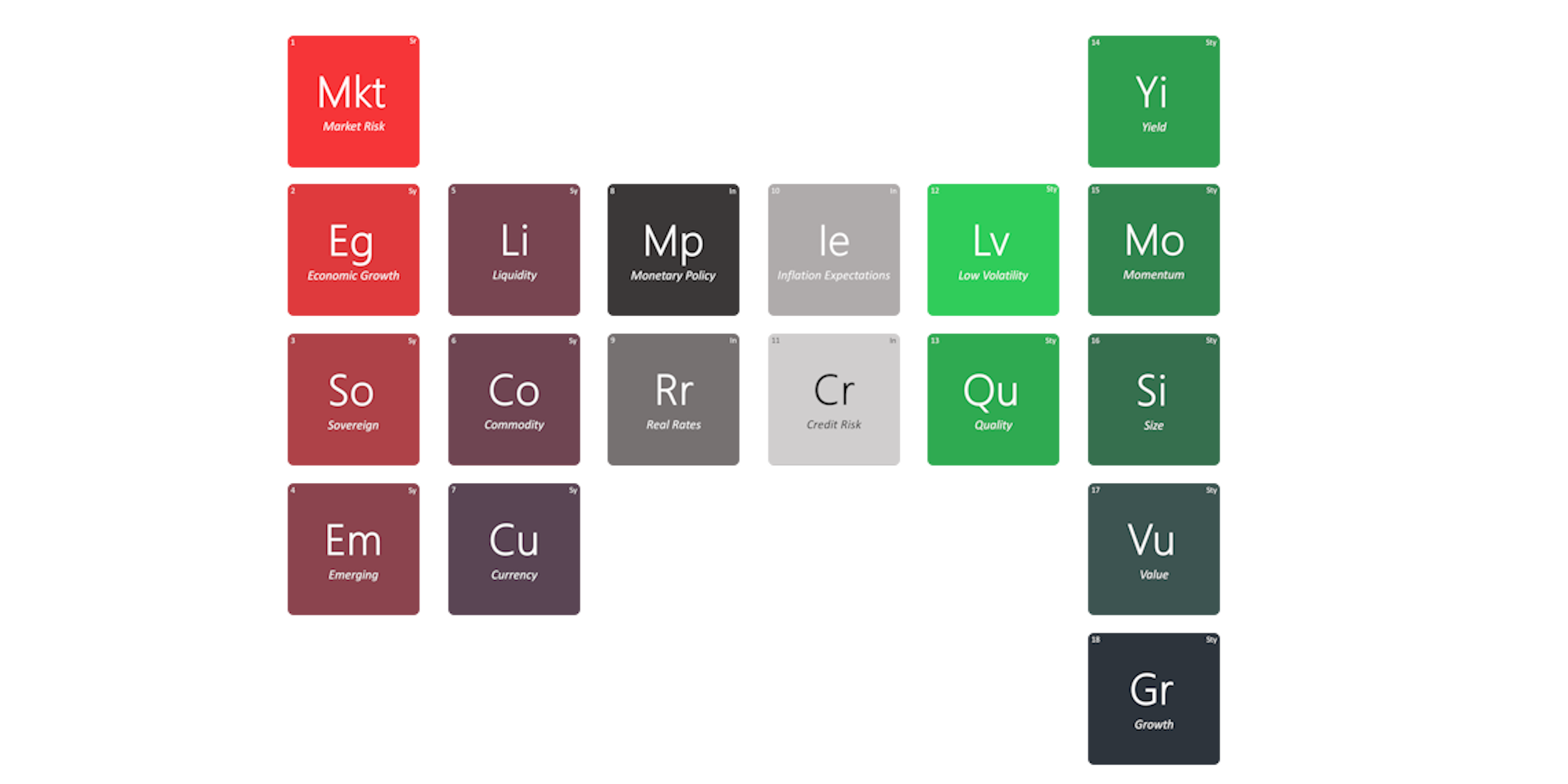

- Diversification: We strategically allocate assets across different classes and factors to reduce overall portfolio volatility.

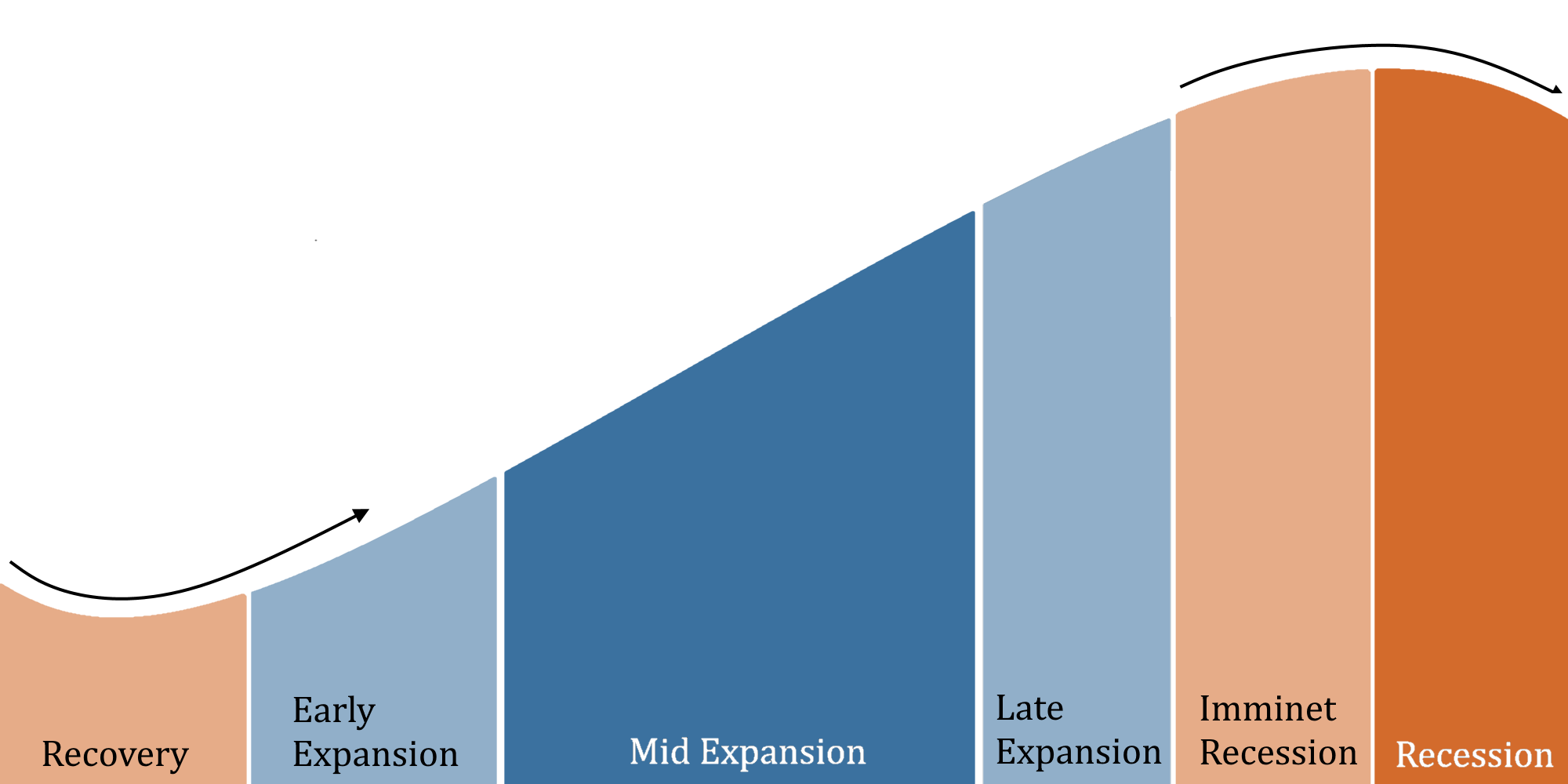

- Tactical Asset Allocation: We adjust our portfolio's exposure to various asset classes based on our assessment of the business cycle, seeking to reduce risk during economic contractions and capture opportunities during expansions.

- Hedging Strategies: We may utilize hedging techniques to further mitigate specific risks, such as interest rate fluctuations or geopolitical events.

One of our key risk management strategies involves adjusting portfolio allocations based on the prevailing macroeconomic environment. During periods of economic expansion, we may increase exposure to assets that typically thrive in such conditions, such as equities. Conversely, during economic contractions or periods of heightened risk, we may shift towards more defensive assets like fixed income or alternative investments.

Macroeconomic Insights: Guiding Our Investment Decisions

At Omega Squared, we believe that a deep understanding of macroeconomic trends is essential for making informed investment decisions. We have developed a proprietary model that classifies the business cycle into distinct stages, each with unique characteristics and investment implications. By identifying the current stage of the cycle, we can anticipate potential market shifts and adjust our portfolios accordingly.

Our research has shown that different macroeconomic regimes offer varying risk-reward relationships. By analyzing historical and current risk premia, we can identify assets and factors that are likely to outperform in the current environment, allowing us to construct portfolios that are both resilient and positioned for growth. By analyzing historical and current risk premia within the context of our business cycle model, we can identify assets and factors that are likely to outperform in the current environment. This allows us to dynamically optimize portfolios to maximize returns while managing risk effectively.

Client-Centric Solutions: Tailored to Your Needs

Omega Squared is committed to delivering personalized investment solutions that align with your unique financial goals and risk tolerance. We understand that every investor is different, and we take a collaborative approach to build portfolios that meet your specific needs.

We believe that a static portfolio is not sufficient in today’s dynamic market environment. Our Smart Alpha approach allows us to actively manage your portfolio, adjusting it in response to changing macroeconomic conditions to help you achieve your investment goals.

Whether you are a high-net-worth individual, a family office, or an institutional investor, we offer a range of investment strategies tailored to your risk profile and investment objectives. Our team of experienced professionals is dedicated to providing you with the highest level of service and support.

Request an Appointment

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.